Investors and analysts are cautiously optimistic about the listing of extreme US stocks seeking a valuation equivalent to Weilai Automobile.

China’s rapidly rising new car-making companies are in the fiercest market competition, which makes them more motivated to seek rapid landing in the capital market. The latest one is Krypton, which has just been established for two years.

If the IPO is successful, Krypton will be the fastest start-up car company established and listed. At present, the China Securities Regulatory Commission has confirmed the filing information of Krypton’s listing outside the United States, and Krypton also started a roadshow three weeks ago to test investors’ reaction.

If it goes well, this IPO with a financing scale of over US$ 1 billion will become the largest IPO of China companies in the United States since Didi raised US$ 4.4 billion in mid-2021.

A number of investors told the interface news that there is a great possibility of successful listing.Even when the capital is the most active, it takes the shortest time to build a car.It also took four years.

A person close to the investor of Krypton roadshow told the interface news that Krypton has not yet negotiated with domestic and Hong Kong investment institutions, and the focus is still on overseas investors. As of the beginning of September, Krypton has held water testing meetings with some investment institutions in Singapore and Europe.

Judging from the preliminary negotiation results, Krypton hopes to get a valuation of $18 billion, which is equivalent to the current US stock market value of Auto, whose latest market value has reached $18.274 billion.

Several industry investors told Interface News that this valuation was higher than expected. For reference, the acquisition of shares of Volkswagen GroupThe latest market value after the stock price soared was $15.8 billion. In February this year, the post-investment valuation of Krypton Pre-A financing was $13 billion.

Considering that it is still in the early stage of intentional communication, there will still be room for downward adjustment in the offer to investors.

In recent years, more and more traditional automobile manufacturers in China have established brand-new electric brands, launched independent teams and new products equipped with the latest technology. They are eager to occupy the global pure electric vehicle market and pursue success in the long-term capital market.

Extreme krypton isIts pure electric brand is also one of the new brands of traditional automobile companies that are closest to IPO at present. At the same time, it is reported that Ai ‘an, a sub-brand of GAC, may be listed before the end of the year.

Krypton is likely to become another China automobile company to land in the US stock market. It has been three years since Tucki was successfully listed on the NYSE, and it is the last new China car-making force to land on the US stock market.

It must be admitted that at present, Krypton wants to get a market valuation equivalent to the next "Wei Xiaoli", and the difficulty coefficient doubles.The environment in which it is listed in the US stock market is completely different from the active period of the capital market, and the enthusiasm of investors for the reform of the automobile industry has gradually cooled down.

The craze for China companies to go public in the United States began in the 1990s, and the China electric vehicle startup "Wei Xiaoli" with Internet genes also relied on the east wind at that time.After ringing the bell, it gradually grew into China’s headCar company.

This close capital cooperation relationship between China and the United States changed at the end of 2020. Subject to enhanced regulatory review, extremely high inflation and risingIn the past two years, the number of Chinese stocks listed on the US stock market and the scale of fund-raising have dropped sharply.

The closure of the listing window in the United States has limited the financing of some start-up electric vehicle brands to some extent, but it has not prevented the China automobile industry from completing the alternation of the old and new order. At present, about one car in every three cars sold in China is a car, except for thisExcept, all the other best-selling models are China brands.

The new force of making cars is no longer the only protagonist in the automobile market. Traditional automobile manufacturers in China have hatched brand-new electric brands one after another, and participated in the competition with the mentality and urgency of start-up companies and the talent structure similar to that of technology companies.

These new energy sub-brands also hope to win the favor of investors. This can not only ensure that it has sufficient funds to cope with the subsequent market competition, but also reduce the cost burden of the parent company in the transformation of new energy.

After the financing fever of electric vehicle start-ups peaked in 2021, the Federal Reserve continued to raise interest rates to fight inflation in 2022, and the borrowing cost rose sharply. Wall StreetIssuance, bond financing and corporate merger have all slowed down to almost exhaustion.

Although the rising cost of capital is also impacting speculative enterprises in other fields, capital-intensive electric vehicle startups have been hit harder.

The cost of establishing a new automobile manufacturing enterprise is high in the early stage, and it will take several years to make a profit. Investors are willing to pay a premium for potential high returns in the era of hot money, but those days are gone forever.

Investment bankers, lawyers and investors believe that although there have been signs of recovery this year and the market has gradually rebounded, it is unlikely that the US IPO market will return to the level of 2020 and 2021. Start-ups need to re-adapt to the new investor mentality, that is, pay attention to the potential of start-ups to achieve profitability, rather than the ability to achieve rapid growth.

Gui Lingfeng, director of Kearney Consulting, told Interface News that the US capital market still has reservations about emerging projects such as China Stock Exchange, including Krypton, and vehicle manufacturers that only provide pure electric vehicles.

"The layout of Krypton in Europe is not easy, especially in German-speaking areas. The core is to enhance the sense of existence in front of overseas investors as soon as possible. From this perspective, they themselves realize that overseas investors are more conservative about their own business models, products and prospects. "

Judging from the valuation model, Krypton is still regarded by investors as a technology-based enterprise, not a traditional automobile manufacturer.An industry insider who asked for anonymity pointed out in an interview with Interface News that the current valuation of krypton in the industry is based on 2 to 3 times the sales rate.

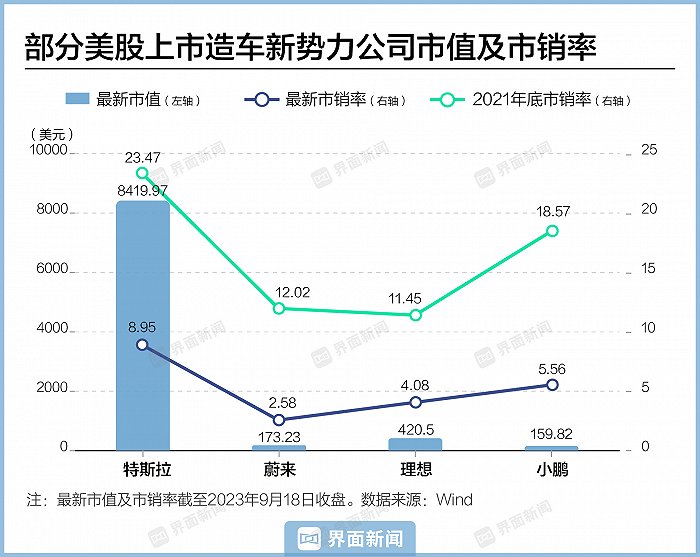

"From the perspective of open market information, the sales rate of 2 to 3 times has actually been placed in the’ first echelon’, and the valuation prospects are more promising." After the extrusion of the high valuation bubble, the marketing rate of "Wei Xiaoli" has also dropped from the high level of more than 20 times in the past to 2 to 4 times.

In contrast, the median sales-to-sales ratio of auto companies listed in the US stock market is 0.81. Traditional automobile manufacturers Toyota, Honda, Stellantis and Krypton’s parent company all have sales rates below 1 times.

Market-to-sales ratio (PS) is often used to measure the valuation of unprofitable high-growth start-ups, which refers to how much investors are willing to pay for the company’s revenue of one yuan.

For the unprofitable extreme krypton and new car-making forces, the core of investors’ evaluation of market value is not the income from car sales, but largely depends on the future software charges with higher marginal benefits, technology output and imaginative autonomous driving market prospects.

The particularity of Krypton lies in that it is a China electric vehicle brand that is separated from the traditional automobile company and seeks independent listing.Although the capital market prefers completely independent new brands without burdens, relying on it, Krypton will amortize the platform R&D investment and capital expenditure together with other Geely brands. This is an extremely advantageous advantage, or let the polar krypton present.The data is optimistic.

It is worth noting that Geely Group has the largest number of sub-brands in the world.

"Investors will look at it rationally, and whether the R&D and supply and procurement costs of extreme krypton can be reflected in the gross profit of the financial report through the scale advantage of Geely Automobile.Statistically. "

Gui Lingfeng told the interface news, including how exclusive the vast architecture of SEA can be, and the strategic investors.How much support is given to Krypton will affect the final valuation of Krypton.

If Krypton chooses to postpone its listing for one to two years, it will be more likely to obtain a larger financing amount and valuation.The above-mentioned insiders believe that as the Fed starts to cut interest rates again in the next 1-2 years, it will drive the secondary market to increase its enthusiasm. From the market fundamentals, the volatility of the US stock market declined, inflation eased, and investors began to speculate again.

Considering its own financial situation and subsequent development, Krypton hopes to seize the market recovery period as soon as possible and rebound with the market trend.In the first half of this year, the net loss of krypton reached 809 million yuan, which continued to expand compared with the loss of 759 million yuan in the same period of last year. From the construction of offline channels to the completion of the cockpit and the short board of intelligent driving, it is necessary to continue to invest money.

Including from within Geely Group, there is a growing demand for Krypton’s self-financing and independence. Due to the pressure on profitability in the early stage of new energy transformation and the related investment in the start-up business of extremely high-end smart electric vehicles, global rating agenciesandThe credit outlook of Geely Holding Company and Geely Automobile has been adjusted from stable to negative.

During the quiet period of the capital market, many start-ups were forced to do things that seemed unimaginable two years ago: continue to reduce costs and increase efficiency, with profitability as the core benchmark. Some start-ups that failed to get external financing support in time, with the passage of time, their cash reserves are decreasing day by day, and eventually they will go bankrupt or be acquired.

Compared with the competition for customers, automobile manufacturing is more a competition for capital, especially in the initial stage.Compared with other traditional automobile companies’ sub-brands, Krypton is one of the few companies that have the mature conditions for listing.

At present, Krypton has initially taken shape. Last year, the annual sales volume of 70,000 single-model vehicles was enough to tell the next story to the capital market. the year of 2020At the time of listing, the annual delivery volume was 32,600 vehicles.

Another factor that is easily overlooked is that Geely Automobile, the parent company, may be the most adept at capital operation in China, and its experience in dealing with foreign investment institutions for many years has laid the foundation for the listing of US stocks today. Krypton considered Hong Kong as the first listing place, but finally chose new york, which also reflected its confidence and ambition-hoping to get a higher valuation in the world’s largest capital market.

In 2010, Geely Automobile succeeded fromThe acquisition of Volvo in the hands staged a classic of "snake swallowing elephant" in the history of automobiles.The case also made Geely Automobile go to the world. After that, the investment portfolio of Li Shufu, chairman of Geely Holding Group, also includes a part of the equity of aston martin, a sports car brand, and a dominant interest in electric vehicle start-up brands such as Polar Star and Lotus Technology.

Before the successful listing of Krypton, Li Shufu had been listed for several subsidiaries in the past two years. Volvo in Stockholm, Sweden in 2021The exchange made a public offering, followed by Polar Star and Yijiatong. Lotus Technology also reported this year that it will be listed on the US stock market through SPAC.

The investment institutions involved in the above-mentioned listing actions are very likely to appear in the extremely kryptonian investor list. Thanks to the close contact between the parent company and global investment institutions, Krypton at least does not need to introduce where he comes from when negotiating with foreign investors.

Some people commented to the interface news that Geely Automobile will not make an uncertain listing plan. Except for the listing of ants in 2021, Geely Automobile withdrew its listing in science and technology innovation board, and all other listing targets were successfully achieved.

Investors’ concern about Krypton is how to achieve the goal of selling 650,000 vehicles in 2025 while ensuring their independence.In investment, platform sharing andandIn terms of the supply of scarce parts, there will inevitably be conflicts of interest between Krypton and other high-end electric vehicle brands under Geely.

Extreme Krypton, Volvo, Polar Star, Lotus Technology and Geely andThe jointly launched Extreme Vietnam is striving for the same customers, and some of the models they developed are based on the common vast SEA architecture, and even some models are produced in parallel.

The Wall Street Journal quoted investor analysis as saying that Geely Automobile’s listing of its subsidiary, rather than the holding company itself, may make the governance challenge of brand competition more difficult: any hint that Li Shufu prefers a subsidiary is a minority.Will be very important for everyone.