On-the-spot record of innovative ideological and political work in Daqing Oilfield

Topic: Welcome to The 17th National Congress of the Communist Party of China

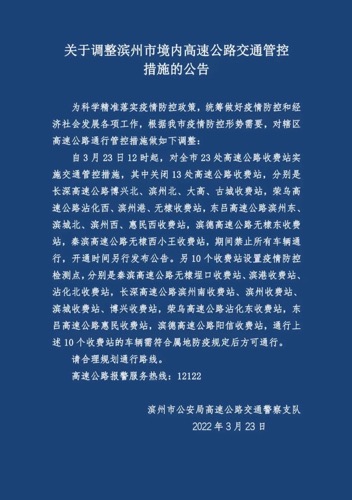

On September 14th, 2007, tourists visited the Iron Man Wang Jinxi Memorial Hall in Daqing. Xinhuanet Pan Xiaoliang photo

Xinhuanet Harbin, September 24th Title: Make Daqing Red Flag Brighter ―― On-the-spot Report of Innovative Ideological and Political Work in Daqing Oilfield

Xinhua News Agency reporter X power Wang Huaizhi Fan Yingchun

On the vast Songnen Plain in Northeast China, blue sky, grasslands and lakes set off towering drilling rigs and orange pumping units. This is the largest oil production base in China-Daqing Oilfield of China Petroleum.

Anniversary, the name of the National Day, which was born of oil, is accompanied by the strong footsteps of the Republic’s development, such as rushing blood, injecting into a strong body and supporting the national petroleum strategic security.

In the autumn season, the reporter once again came to Daqing to feel the elegance of the oil industry giants. While sharing the joy of oil people’s harvest, he was also encouraged by the more vivid Daqing red flag tempered by the wind and rain.

"You can’t just grab the drill bit, not the head."

The construction achievements of Daqing Oilfield have attracted worldwide attention, but it is not always smooth sailing behind its glory. Declining resources is the natural law of mining enterprises. After more than 40 years of development, the comprehensive water cut of the main oil fields in Daqing is as high as 90%, and the recovery rate of recoverable reserves in the oil fields is as high as 80%. In 2003, the output of crude oil was reduced to less than 50 million tons for the first time, which made Daqing people who have been pursuing stable and high production and have a strong sense of mission feel confused and confused, and caused various discussions and suspicions from outside: "How long can Daqing red flag last?" Will it be "oil exhausted"?

How to add color to Daqing Red Flag? The party committee of the oilfield has deeply realized that development is the last word, but if people’s problems are not solved, development will lose its foundation. Zeng Yukang, deputy general manager of China Petroleum Group, director and party secretary of Daqing Petroleum Administration Bureau, said: "Development needs to unite people’s hearts, and we must never only grasp the drill bit, but not the head."

The scene of reading "Two Theories" by the bonfire of Iron Man Wang Jinxi is fixed in people’s memory. In the new era, Party committees at all levels in oil fields insist on studying theory and arm cadres and workers with the latest achievements of Marxism in China. Training courses, academic lecture halls and online training colleges are widely held, and the combination of learning and application is promoted through the mechanism of telling, evaluating and examining, so as to apply what has been learned.

Under the guidance of theory, Daqing Oilfield applies scientific development and harmonious development to oilfield planning and production practice, establishes the development strategy of "creating a century-old oilfield and doing a good job in secondary entrepreneurship", and defines the phased goals: by 2010, the oil-gas equivalent will remain at 42 million tons; Realize "domestic first, international first-class"; An important petroleum equipment manufacturing base in China has been built, with business income reaching 10 billion yuan.

Wang Yupu, chairman and general manager of anniversary Oilfield Co., Ltd. said: "According to this strategy, anniversary will contribute more than 60 million tons of oil and gas equivalent to the country in the next 15 years." The bright future has become a powerful spiritual motivation. In view of the doubts and confusions caused by the production reduction, the oilfield concentrated on six months to carry out a big discussion on "emancipating the mind and planning for development", guiding employees to find opportunities in challenges and potentials in difficulties, and actively participating in the practice of "a century-old oilfield, starting a second business".

Daqing Oilfield is distributed in 6000 square kilometers of land, with more than 5000 grass-roots stations. The oil field extends the "tentacles" of ideological and political work to the most basic level. Through the party branch of each basic unit, it can keep abreast of the ideological trends of employees, understand the needs of the masses, and solve practical problems and difficulties in production and life. In the oil field, many party member, who terminated the labor contract with compensation, regarded it as a major event to return to the Party branch to organize life regularly.

Like a warm spring breeze, ideological and political work has blown away the "bumps" in Daqing people’s hearts, dispersed the shadows and brought about a harmonious development and prosperity. Since 2000, the oil field has produced 338 million tons of crude oil and 15.48 billion cubic meters of natural gas, and the average annual oil-gas equivalent has remained at 50 million tons. The largest onshore natural gas field in eastern China has been discovered, creating a new situation of oil and gas simultaneously.

Up to now, Daqing Oilfield has created the "three firsts" of China’s petroleum industry: the crude oil output is the first, with a cumulative production of 1.91 billion tons of crude oil, accounting for more than 40% of the total onshore crude oil production in the same period of the country; Paying profits and taxes first, and paying taxes and fees for the country totaled 973.4 billion yuan; The recovery rate of crude oil is the first, and the recovery rate of main oil fields exceeds 50%, which is 10-15 percentage points higher than that of similar oil fields at home and abroad.

"Inheritance is not conservative, and innovation is not rooted."

"There is no oil in a well without pressure, and people are light without pressure", "Workers work in three shifts, and each shift sees the leader", and "Leaders have employees in their hearts, and employees have enterprises in their hearts", which are the ideological essence rooted in the traditional battle of the year and are family heirlooms of Daqing, and are still widely used in work practice.

Jiang Wanchun, deputy secretary and deputy director of the Party Committee of Daqing Petroleum Administration Bureau, said: "The traditional methods of ideological and political work are taken from practice and have been tested by history, so we can’t lose them at any time. In particular, the Daqing spirit and the Iron Man spirit are a good starting point for us to carry out ideological and political work in the new stage and carry out ideological education for employees. They are the soul of the oilfield. "

The Iron Man Wang Jinxi Memorial Hall, which was relocated and completed in September 2006, has attracted more than 300,000 visitors in the past year. This is the spiritual holy land of Daqing people and the first classroom for workers’ factory education. Before employees’ children leave Daqing for further studies, parents will take their children to the Iron Man Statue, telling them not to forget the tradition and keep their true colors. When some young workers get married, they will wear costumes to report the good news to the old captain of the Iron Man and accept silent blessings.

The wheel of the times is carrying Daqing Oilfield into the new century. Facing the new situation, tasks and active ideology of workers and staff, the oilfield has linked the traditional ideological and political work methods with the construction of advanced enterprise culture and found a new combination point. With an open mind, they widely absorb advanced cultural concepts and innovate corporate culture construction.

"Daqing Oilfield, cheer for the motherland!" It is the new core concept of oilfield and the common aspiration of Daqing people. It makes oil people always have a full and proud smile on their faces in ordinary and monotonous labor, and makes them excited for the great cause of national rejuvenation.

"Limited resources and unlimited science and technology" is a portrayal of the combination of Daqing people’s dedication and scientific and realistic attitude of "asking for resources from science", which condenses the minds of petroleum scientists and technicians and constantly explores and develops unknown fields.

Combined with the construction of corporate culture, many methods of ideological and political work have been innovated in the inheritance of oilfield: "learn with questions and find answers", and test the theoretical learning effect by applying what you have learned; "Running through the main line, the channel does not change", promoting practice with theme education; "It’s better to show it to the employees than to say a thousand words and ten thousand words", and use the leading role to drive the employees; "People around us talk about things around us, and things around us touch people around us", use self-education to stimulate employees’ internal motivation, and use modern media to expand the coverage of ideological education. These innovations with distinctive characteristics of the times have enriched the ideological and political work in oil fields.

In order to enlarge the effect of combining ideological and political work with advanced enterprise culture, the oilfield takes the grassroots as the focus of its work, arouses the enthusiasm of grassroots cadres and workers, and respects the pioneering achievements of the masses. The reporter’s interview at the grass-roots level is like walking in a big garden of corporate culture, with crystal dew on those bright and different flowers.

"Testing the oil well, testing the character" is the cultural concept created by the testing system. And "Party A’s high standard makes Party B’s high level" comes from the market development system; Spark primary substation put forward that "gathering is a fire, scattering is all over the sky"; The North Tenth Five-Year Joint Station believes that "today is always the starting point".

Sun Shuguang, secretary of the Party Committee of Daqing Oilfield Co., Ltd. said: "Inheritance is not conservative, and innovation is not rooted. These cultural ideas, which originated from workers and came from the front line, are vivid and concise, and are easy for workers to understand, accept and put into action. These innovations have greatly enriched the connotation of ideological and political work. "

In Daqing, it is a tradition and fashion to respect model workers and advocate advanced technology. During the battle, every time the model worker came back with honor, he had to wear red clothes and flowers and sit on his horse, but the leader led the horse. Nowadays, Daqing treats model workers, advanced and outstanding scientific and technological personnel, awards cars, gives titles, gives topics and burdens, making advanced models more "loud" and "fragrant".

In the oil field, many technological innovations named after ordinary employees have achieved fruitful results in their application. Wang Chunrong, a well washer in No.2 Oil Production Plant, explored a set of hot washing operation method of "inspection, determination, control and inspection", which extended the average maintenance period of oil pump by 767 days and was named "Wang Chunrong’s hot washing operation method". Wang Kun, deputy secretary of the Party Committee of Daqing Oilfield Co., Ltd., said that the naming method sets off the atmosphere of "glorious labor, lofty knowledge, precious talents and great creation" and is the tangible embodiment of ideological and political work.

The reporter looked through the roster of cadres at all levels in the oilfield and found that there were many jobs in the post column where political work posts and production and operation posts crossed. In order to integrate ideological and political work into the whole process of production and operation, the oilfield has explored "four synchronizations", namely, the simultaneous establishment of party and government organizations, the simultaneous deployment of cadres, the simultaneous formulation of systems and the simultaneous assessment of work.

"tangible work, intangible power"

When some people are worried about the system and prospect of state-owned enterprises, Daqing Oilfield has ushered in a good development situation and solved people’s doubts. Strolling through the oil square, what caught the reporter’s eye was a peaceful scene: retired workers and couples took a leisurely walk arm in arm, middle-aged men and women danced with social dance music, and children skated lightly by.

"The prosperous and harmonious situation comes from economic development and is also inseparable from effective ideological and political work. Practice has proved that ideological and political work is ubiquitous and can release huge productive forces. It is a’ tangible work, an intangible force’. " Wang Yupu said.

Interviewing at the grassroots level, the reporter personally felt the great power of innovative ideological and political work in oil fields. Zhongqi Joint Station is the first closed joint station on land in China. The unique family management mode of employees has become a good helper for institutionalized management. Zhou Yuewen, secretary of the Party branch, called up the files in the computer, including the birthday, family status, children’s schooling, parents’ chronic diseases and other information of each employee. Since its establishment 23 years ago, this station has maintained safe production.

Oil production team 43 was established in 1964, which is the "old benchmark" of the oilfield. There is a public toilet in the team. For many years, no one has been assigned to clean it, and no one has been assigned to take charge, but the toilet is always clean. Captain Li Ji said: "whoever finds dirt will clean it up." In our team, not only production, but also all work must strive for the upstream. "

Paying attention to the vital interests of the masses and embodying humanistic care is a distinctive feature of the integration of ideological and political work and corporate culture construction in oil fields. "National interests are the most important, enterprise interests are the most critical, and workers’ interests are the most fundamental", which is the guiding ideology for oil fields to deal with the interests of the state, enterprises and individuals.

In recent years, the oilfield has done everything possible to improve the working and living conditions of the production line, not only providing mobile dormitories with televisions and air conditioners for grass-roots stations and teams engaged in field work all the year round, but also providing "free lunches". The oilfield leader said: "Although the working conditions are still difficult, we must not let the frontline soldiers break down."

Daqing Oilfield has 280,000 on-the-job and retired employees, including some low-income families and needy groups. In recent years, the oilfield has made great efforts to build a harmonious enterprise, tried every means to solve practical problems for the needy people and sent the warmth of the party to thousands of households. Only this year’s "Love Donation Activity", party member Oilfield enthusiastically donated tens of millions of yuan. These help actions strongly influence people’s thinking and enhance the cohesion of enterprises.

When some enterprises were confused about finding spiritual support, Daqing Oilfield gave full play to the party’s political advantages and used colorful ideological and political work to solve many difficult problems in reform and development. When some political cadres feel left out in the cold, party organizations at all levels in Daqing Oilfield are active in all fields of production and life, playing an important role and performing irreplaceable sacred duties.

Guan Youchun, one of the "five red flags in the new era" in the oilfield, is the party secretary of the operation brigade of the No.5 oil production plant. His figure always appears frequently in grass-roots units and the homes of poor workers. Thousands of employees in the team know him, and they come to him for big things and small feelings. He also knows all the employees’ names, and people affectionately call him "the right political worker".

We have learned a lot from the powerful spring. His self-confidence stems from his persistence and love for his career. His affinity among the masses reflects the great charm of ideological and political work in Daqing Oilfield. This charm, such as spring breeze and rain, moistens things silently; Like the bright sunshine, the red flag in Daqing shines more brightly.

Editor: Li Xingchi