How do domestic films win audiences with fine products?

[Cultural and Creative Horizon]

How do domestic films win audiences with fine products?

— — Film market survey in the first half of 2017

Guangming Daily reporter Villi

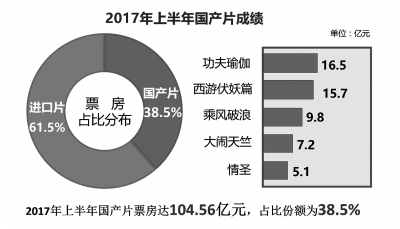

According to the latest data, the national box office revenue in the first half of the year totaled 27.17 billion yuan, including 16.71 billion yuan for imported films and 10.456 billion yuan for domestic films. What are the new features of China’s film box office? Why are domestic films inferior to imported films? How should the structural reform of China’s film supply side be promoted? The reporter conducted an investigation for this.

ⅰ. The game between domestic and imported domestic films accounted for only 38.5% of the box office.

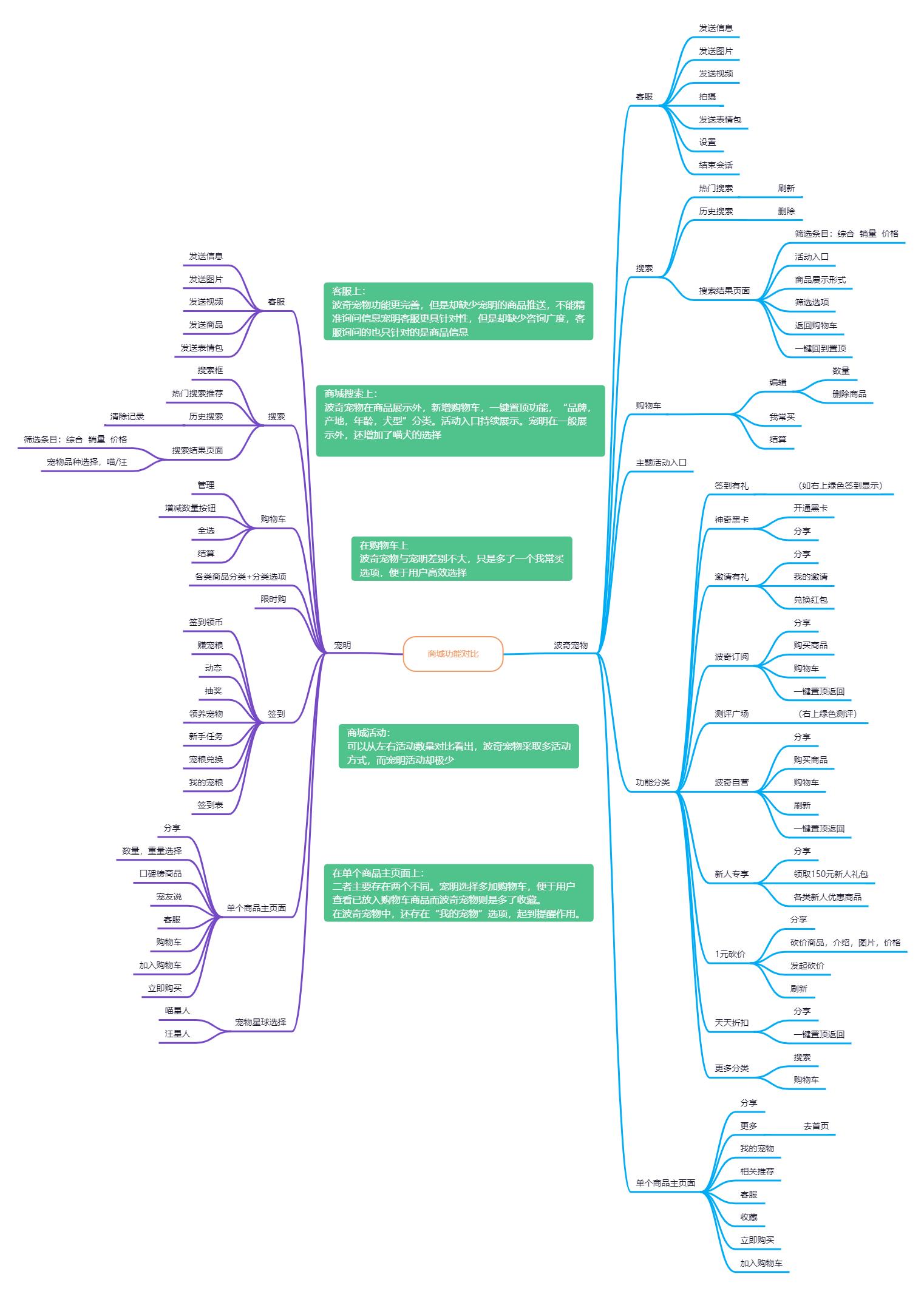

Data In the first half of 2017, the box office of imported films totaled 16.717 billion yuan, and the box office of domestic films was 10.456 billion yuan. In the first half of 2017, the box office of imported films accounted for 61% of the domestic box office. Among them, there are 41 films with box office exceeding 100 million, 17 domestic films and 24 imported films.

Specifically, Speed and Passion 8 ranked first at the box office in the first half of the year with 2.49 billion yuan, and Kung Fu Yoga ranked second with 1.75 billion yuan.

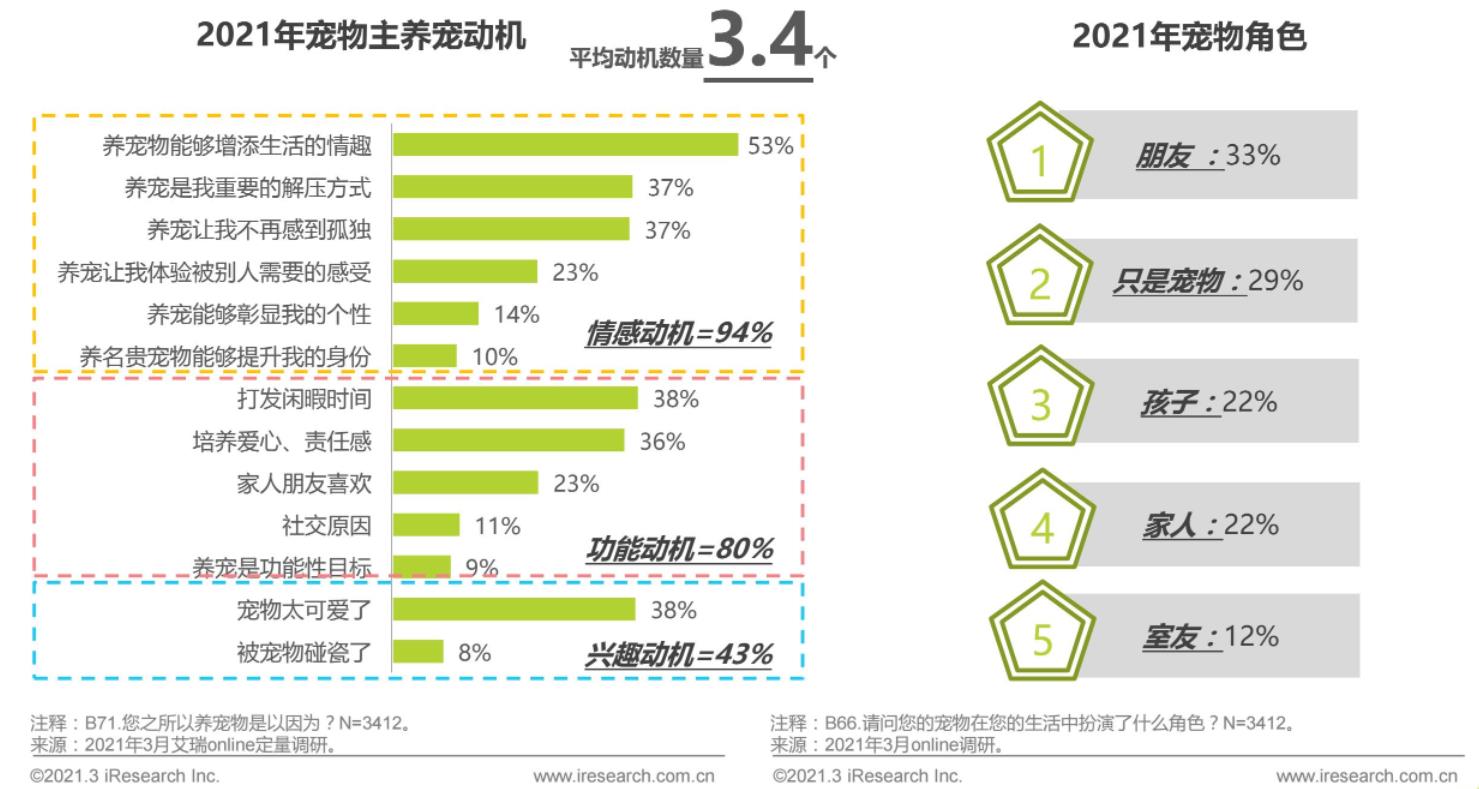

In the first half of the year, domestic films with strong box office performance were basically concentrated in the Spring Festival file, and then the market leader was domestic films. In addition to the Spring Festival movies, the lack of "explosions" is an important reason why domestic movies are not satisfactory in recent months.

Domestic films are not as good as imported films at the box office, especially in March this year. In March, no domestic film grossed more than 100 million yuan, and the market share of imported films reached an astonishing 95.5%, completely monopolizing the mainland film market. In the following months, imported films have been the main box office. At present, among the top ten annual box office, only three domestic films, Kung Fu Yoga, Journey to the West, and Riding the Wind and Waves, occupy three seats.

Judging from the distribution of the overall box office interval, the number of films exceeding 500 million yuan in 2017 is very eye-catching, and the number of films exceeding 1 billion yuan reached 8 in the first half of the year, which is close to the achievement of 9 films in 2016 and much higher than the overall level in 2015, 2014 and 2013. This shows that there are many "heavyweight" products in this year’s film, and the performance is particularly eye-catching.

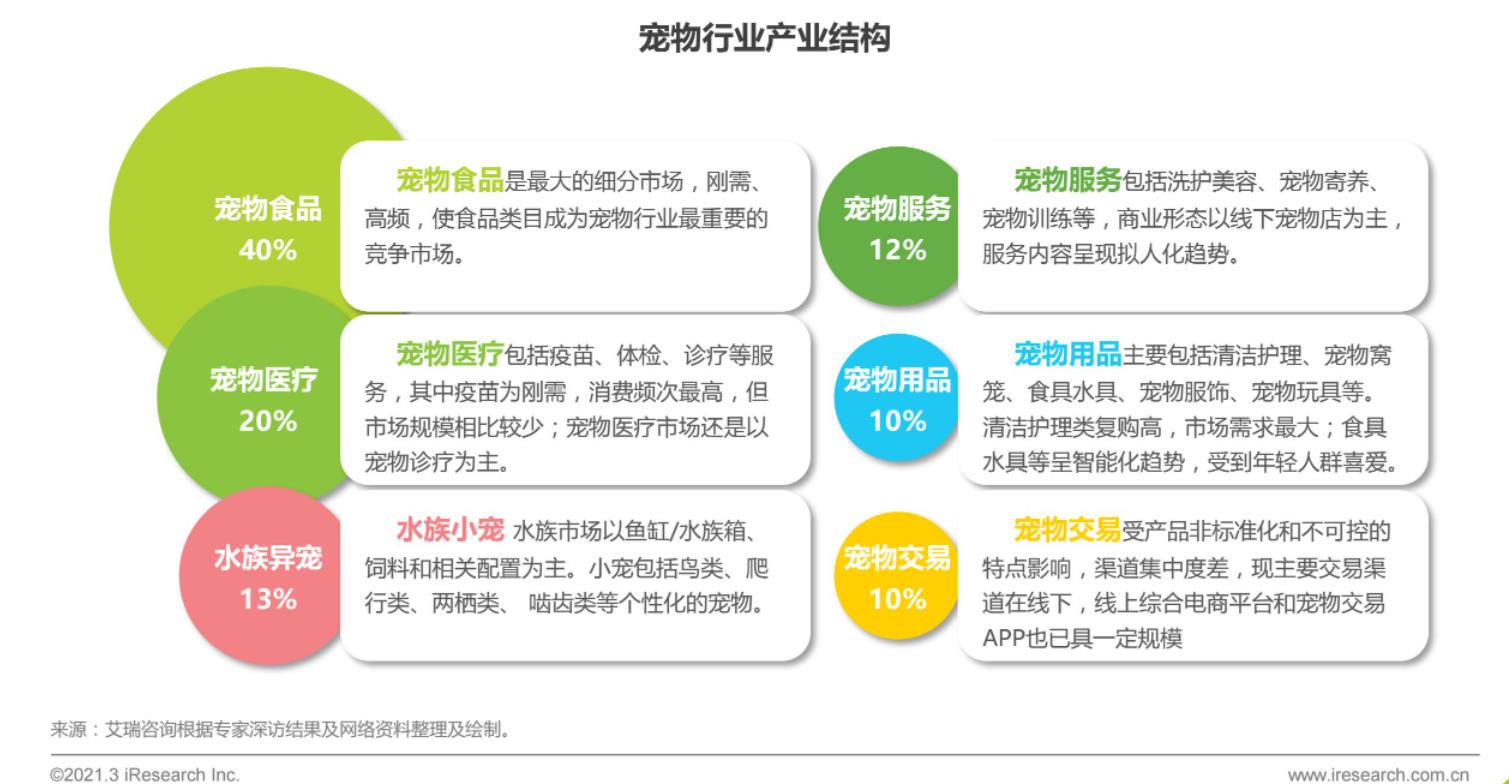

According to industry experts, another reason affecting the overall box office in the first half of the year is the asymmetry between the number and the single box office performance. In 2017, the fantasy genre took the lead with 470 million yuan, followed by action movies with 420 million yuan. Among the domestic films released, the top three types were comedy, thriller and love. As an action and science fiction film with obvious pull-up effect, subsequent domestic films need to make more efforts.

Not long ago, a movie "Transformers 5: The Last Knight" kicked off the summer movie file in 2017. Facing the upcoming summer file, domestic films are eager to try, and domestic and imported films will usher in a new round of game.

Ⅱ. Race between Speed and Quality. The effectiveness of film supply in China needs to be improved urgently.

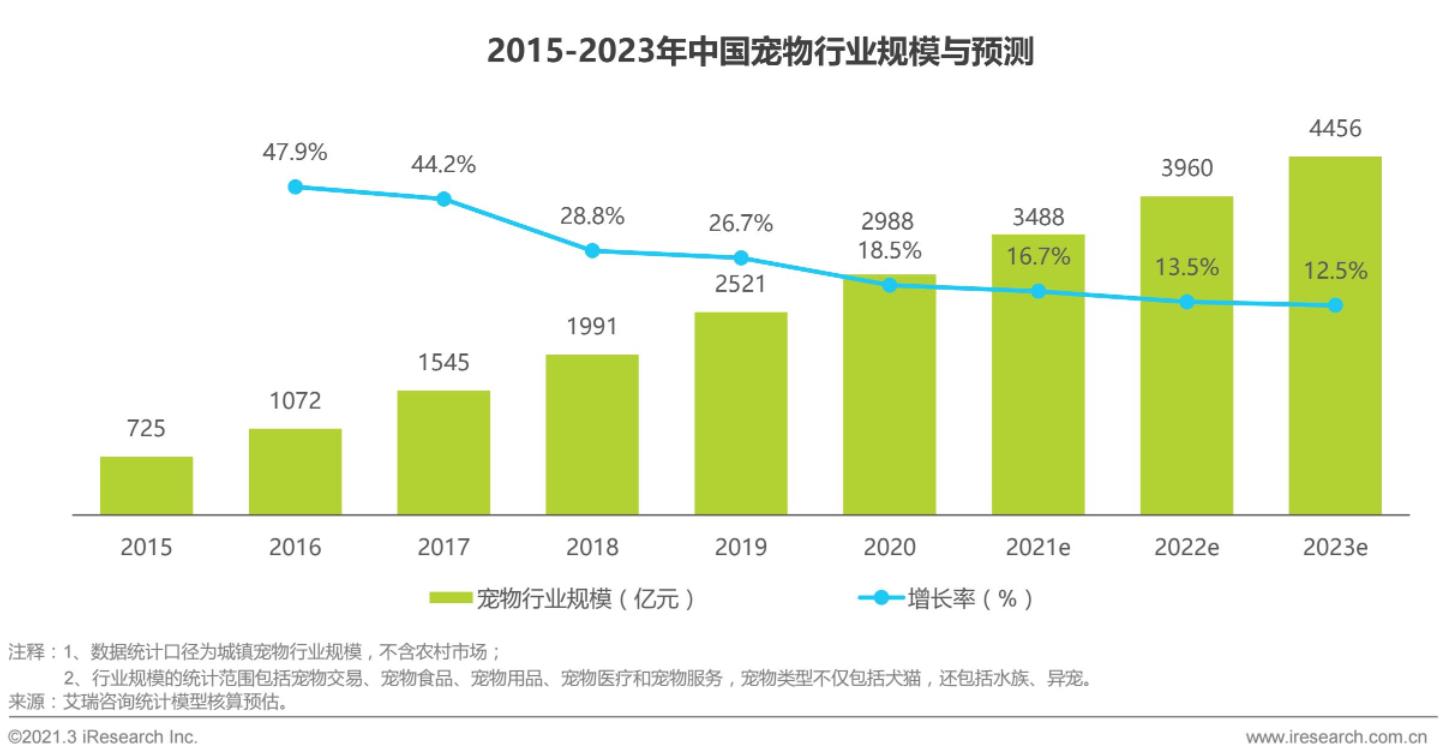

Data The box office of Chinese movies was in 2003— During 2010, it took 8 years to increase from 900 million yuan to 10 billion yuan; It took three years to grow from 10 billion yuan to 20 billion yuan; From 20 billion yuan to 40 billion yuan, it only took two years. The growth of demand has led to the rapid growth of domestic films. In recent years, the number of domestic films has grown from less than 100 to more than 900, and the number of screens has grown from more than 3,000 to more than 40,000, with a rapid growth rate.

From a certain perspective, speed and quality are inherently a contradiction. While seeking speed, quality growth is easily overlooked.

"In 2016, the domestic box office was 45.7 billion yuan, and the overall box office growth slowed down, increasing by 3.7% year-on-year. In 2016, there was a negative growth in seven months. The first half of this year is coming to an end, and the growth of box office in China is still in a stalemate, especially from 3 to 3— — In May, overseas imported films occupied an absolute advantage, taking away more than 70% of the box office in March, April and May respectively. " Ren Zhonglun, Chairman and President of Shanghai Film Group, pointed out that the data shows that the demand for China films is growing, the supply is growing faster, and the availability of supply is declining.

2017— According to the Analysis Report on the Present Situation and Development Prospect of China Film Industry in 2022, in 2016, there were 1,612 new cinemas and 9,552 new screens in China. In 2016, the total number of screens in China has reached 41,179, surpassing the United States to become the country with the largest number of movie screens in the world.

The number of movies in China has increased, and the scale of cinemas has expanded, but the satisfaction of the audience and the satisfaction of demand have been reduced.

There is no increase, in fact, the efficiency of each cinema is also declining. How to speak with content and how to keep the audience in their seats with good stories has become an important issue and test for industrial development.

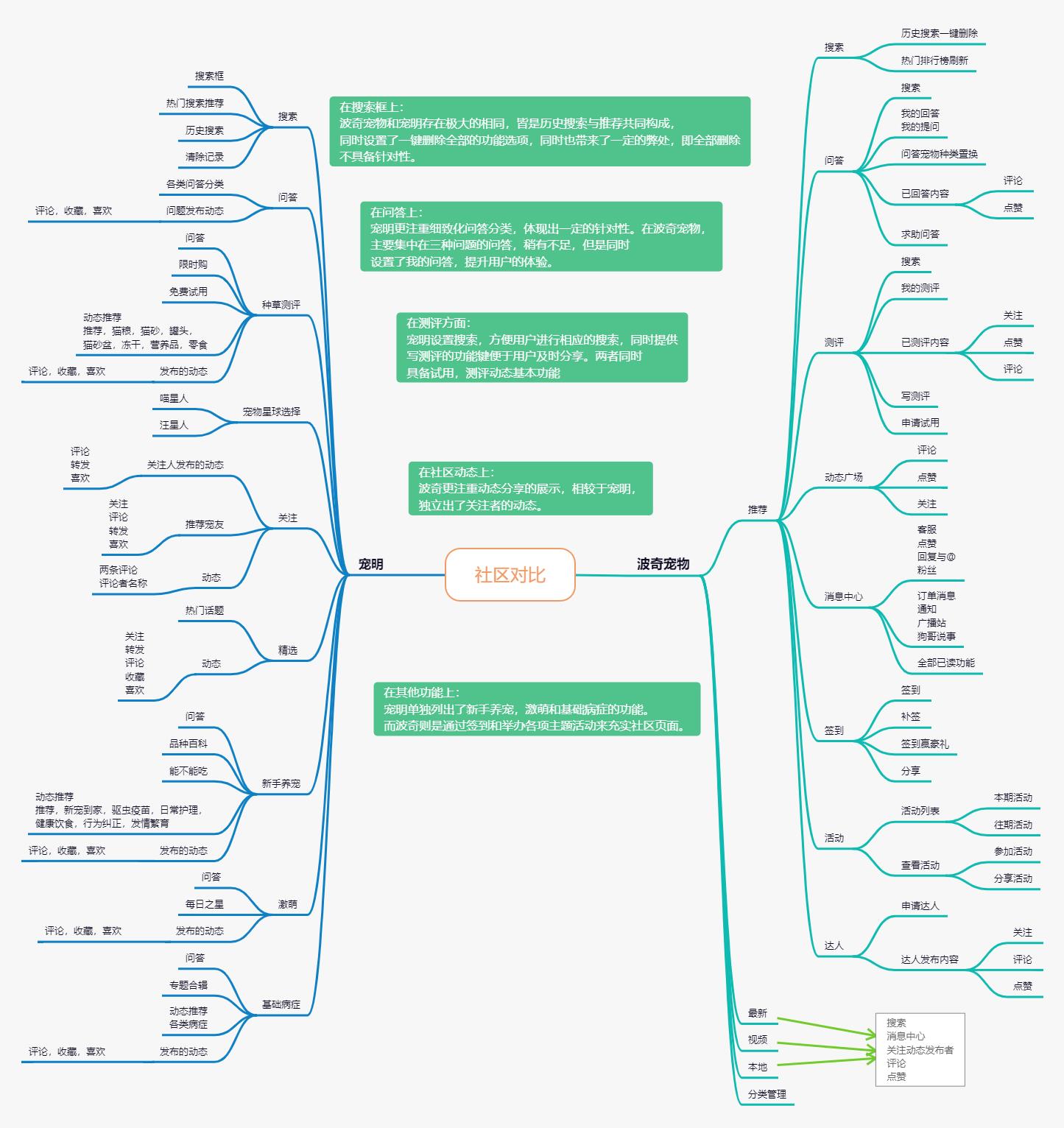

Experts pointed out that at present, domestic films mainly face three problems: one is the availability and quality of supply, the other is that the types are not diverse enough, and the most important thing is the lack of film and television works that can impress people and resonate with everyone.

"Socialist films with China characteristics should be made in Do not forget your initiative mind, and the excellent historical tradition, cultural accumulation and basic national conditions of China films should not be forgotten. The film should spread progressive ideas, inspire people and improve the quality of the Chinese nation. This is the initial intention of the film. " Chengxiang Zhong, the former vice chairman of the China Federation of Literary and Art Circles and a famous literary critic, pointed out at the film "Home" seminar a few days ago that we have shot a large number of films with major themes, but most of them are not aesthetically pleasing and artistic, so they cannot infect people or attract people. Without attraction and appeal, they lack communication power.

"China movies are not short of stories at first, nor are we unable to tell stories. I think stories and cultural creation have always been China’s strengths." Ren Zhonglun said that we are short of good scripts, talents and directors, and our comprehensive ability needs to be improved.

In the view of Jiang Wei, executive director of Gravitation Film and Television, it is not urgent to be a content industry: "If you invest in movies or content, if a fast-forward and fast-out method may not be suitable for this industry, this industry still needs to sink down and make a movie. Good things are made, not robbed. "

Ⅲ. Paradox between Great Powers and Powerful Countries; Domestic films should achieve breakthroughs with fine products.

Data In 2016, the total number of domestic films was 944, and 334 films were shown in cinemas. However, only 15 films scored more than 7 on Douban, and the film industry in China needs a "tempering". In 2016, China only watched movies once per capita, while North America saw 3.7 times. China has 30 screens per million people, while North America has 121 screens.

Faced with the growth of cinema and box office market, many people ask whether the number of movie screens in China is saturated.

"It is too early to talk about saturation at this point in time." Yu Xin, general manager of Dadi Cinema Group, pointed out that there is still a lot of room for growth in the number of screens and box office market in China in the future. We have just passed a rapid growth period and will enter a stable and relatively mature growth period, which has caused a mismatch between supply and demand.

After sturm und drang in the past few years, the film industry in China ushered in a turning point in 2016, with the growth rate dropping to single digits, and the once frenetic development instantly fell to freezing point. Correspondingly, the stock price of individual stocks in the film and television industry has collapsed, and film and television capital has entered a cold winter.

Ren Zhonglun believes that the cold winter of the film and television industry is due to the problems of shoddy production, single type and capital drive, and the lack of Wrestling! Dad, a movie that really touches people’s hearts and resonates. "Our supply has been growing, but the effectiveness of supply is declining. What we need to think about is how to improve the quality, effectiveness and rationality of the film supply structure, and how to make the film industry in China ‘ Pain point ’ Become ‘ Highlight ’ 。” Ren Zhonglun said.

Ren Zhonglun takes a set of data as an example to analyze. In 2016, the total number of domestic film productions reached 944, only one step away from the annual output of 1,000. Among them, 334 were shown in the cinema. China is already a big movie country, but "big" doesn’t mean "strong", and it lacks high-quality movies that can really satisfy the audience and classic works that can be remembered by the audience.

"Domestic films should respect the audience." Wang Zhonglei, vice chairman and CEO of Huayi Brothers, said that movie audiences in China are not young people who just want to entertain and don’t think, as described in big data. Their taste and judgment have been improved rapidly in recent years. Facing the slowdown of box office growth and the pressure of overseas blockbusters, there is only one way for China films to make a breakthrough, that is, to produce truly high-quality films and meet the demand of China film audiences for good films.

Guangming Daily (July 9, 2017, 07 edition)